Asset Management

Objective

At CWP, our goal is to manage client portfolios conservatively with low volatility, while pursuing long-term capital appreciation through a well-diversified set of investments. Our experience helps us identify an appropriate risk tolerance for our clients that align with their long-term financial goals. Adhering to the agreed upon guidelines, CWP manages all accounts of a household as one portfolio. We believe this to be the appropriate way to manage risk across all assets for a client.

Philosophy

Through our broad understanding of market fundamentals and constant monitoring of the macro investment landscape, we believe investors often overreact in the short run due to emotion or excessive optimism, which may result in mispriced assets from time-to-time. With a focus on fundamentals, we invest in assets that we deem undervalued or are trading at a discount to their intrinsic value. We also believe companies that return capital to its investors on a sustained basis over long periods of time tend to produce better overall returns, which is consistent with our goal of providing our clients a steady stream of income and capital appreciation.

Process

Having a strong understanding of the economic cycle and identifying shifts is the focal point of our investment strategy and asset allocation. To assess prospects for economic growth, inflation, interest rates, exchange rates, trade and capital flows, and business cycle, we closely monitor economic and policy developments, business activity, and the geo-political environment in all the major developed and emerging economies. This helps us make sound and timely investment decisions.

Modeling

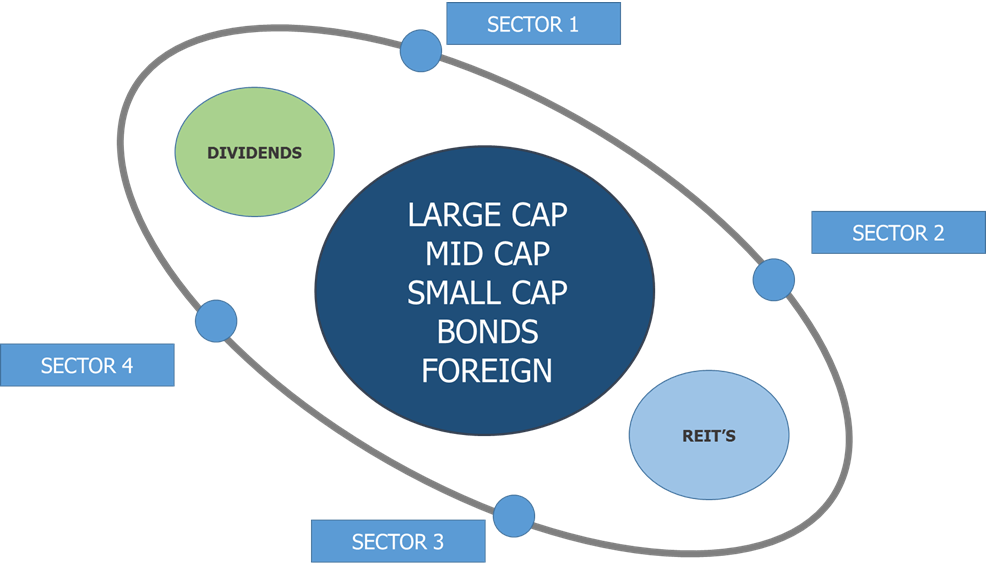

Our investment strategy is centered around an asset allocation model, focusing on the “core and satellite” method. Core investments consist of index funds that track various market capitalizations in both domestic and foreign markets. Satellite positions consist of sectors and other opportunities that match our philosophy. We maintain a buy and hold approach with core investments in normal market conditions, while satellite positions are rotated at various points of the business cycle.

A model is assigned to each household based on their desired risk tolerance, objective, and total investable assets. We define “risk” as the amount of equity exposure in each model. As equity exposure increases, the risk of the model increases. Below are the models and their respective equity exposures:

Model |

Base Equity Exposure |

Conservative Income |

35% |

Moderate Income |

45% |

Balanced Income |

55% |

Moderate Growth |

65% |

Growth |

75% |

Aggressive Growth |

85% |

Assets held away (e.g. 401k accounts) are assigned an asset allocation model. We match exposure on the asset class level to the model that they are assigned, which allows us to maintain the overall risk level of the client’s household.

Strategic Allocation

In line with a client’s risk profile, asset class weights are fixed across various models and rebalanced on a quarterly basis to bring them back to model. Within an asset class, weights of specific assets are allocated based on our assessment of the current macro environment. Securities within an asset class are selected based broadly on scenarios of growth and inflation. A strong understanding of where growth and inflation are trending, as well as, following key indicators to gauge the rate of change in economic activity, helps us identify where we are in a business cycle. This allows us to pick sectors and style factors that perform well in various phases of the business cycle and economic environments. Accurately identifying key trends is an integral part of our strategy. Once identified, these trends form the basis for our individual security selection within sectors or style factors in the current investment environment.

Risk Management

We place our highest priority on protecting our clients’ assets. To control risk, we work to limit volatility across all assets. Our portfolios are modeled to have a lower beta, while risk adjusted returns are designed to be in line with broad market performance. We employ a risk on, risk off approach, which allows us to tactically shift the weighting of the models during uncertain markets.